Economic development through municipal tax reform

August 12, 2021

Capitalism elegantly solves problems by crowd sourcing them to entrepreneurs. However, free markets are vulnerable to distortion. When markets are distorted people make economic decisions based on incorrect incentives and information. It is my belief that our local economic market is heavily distorted because of the way Medicine Hat distributes our tax burden.

There is currently no connection between your individual tax bill and what it costs the city to service your property. This has skewed residential development in unsustainable ways and placed an unnecessary drag on business for decades. The negative, cumulative impact can hardly be overstated.

Dividing up City Hall’s tax burden is like dividing a pie. Make one piece smaller, others get bigger. Given this tricky balancing act we need to be intentional and careful about this choice.

We should adopt a principle of neutral cost recovery when setting tax rates. It’s impossible to perfectly connect municipal tax rates with servicing costs, but we can get much closer than we currently do. This would rebalance the tax burden in more equitable, neutral ways.

Ensuring a fair framework for competition, where costs are better accounted for, would unlock economic development in more interesting, healthier and sustainable ways than forcing economic growth through artificial subsidies.

Business taxes need to come down. They have been shouldering a disproportionately high tax burden with poor justification. This would greatly help small businesses, which account for 96% of all businesses.

Single family detached residential tax rates need to come up. Most of us, myself included, live in single detached homes. This type of low density housing is the most resource intensive lifestyle in terms of materials and ongoing municipal servicing costs. There isn’t anything inherently unsustainable about low density housing. It only becomes unsustainable when these types of developments don’t cover their costs. That is currently the case—city council doesn’t collect enough in taxes to cover the cost to service these neighbourhoods. People should be free to live in any type of housing they want. But that lifestyle choice comes with costs. I don’t see why anyone else should carry the burden of my choice.

I also feel that the single family detached house is an important component in solving the housing affordability challenge. These seem like contradictory statements, but they’re not. I will discuss the issue of housing in an upcoming column.

Rates for medium density and higher density housing need to come down. Currently, rental apartment suites pay +22% higher taxes. City council admits internally and publicly that higher density housing costs the city less to service. The rationale for this tax rate from city council is that apartment building owners can write off their tax bill. Great, then why not +40% (like Lethbridge) or even higher. That owners can write off their tax bill is irrelevant. The tax rate for higher density housing should reflect its lower servicing costs. The situation is worse when you consider who often live in rental apartment suites—those economically disadvantaged. All Medicine Hat Community Housing Society apartments fall under this tax rate. Their tax bill is $160,000/year. If we charged multi-family rentals the same rate as single family residential (still too high in my opinion), that's $35,000 more the Housing Society would have year over year, decade after decade. Over the past twenty years this type of housing has paid an average of +24% each year than low density housing. I don't like speaking about policy in moral terms because it's lazy. But it's hard not to see this policy (and every year it persists) as an injustice. We’re burdening those most vulnerable in our community with pretty sketchy justification.

I believe we can quantify the cost of different housing densities. Those cost differences then must be applied to newly created tax categories of corresponding housing.

As we ease the burden on business we’ll see a more vibrant local economy. Rebalancing the tax burden can only be done slowly. Everyone will have plenty of time to adjust.

A refresher on municipal budgets and taxes

Municipal taxes are based on the principle of neutral cost recovery. Your elected representatives on city council agree on an overall budget for city services. Then we work backwards to recover exactly this amount through property taxes.

Once the overall budget is set city council then distributes the tax burden between the different types of properties. There is no right or wrong way to distribute the tax burden, but regardless of what we choose we should do so intentionally and with our eyes open.

The way we do things now

City council can create any number of categories to better target different types of properties, but we’ve chosen to create three broad categories. Each with its own tax rate.

Single family residential: single detached houses and individually owned condos

Multi-family residential: rental apartment suites

Non-residential: commercial and industrial properties

Here are the tax bills for different types of properties valued at $250,000. The single family detached home rate is the standard comparator when looking at the relative tax burden. Let’s first compare our commercial tax rate against the single family rate.

Residential and Commercial taxes

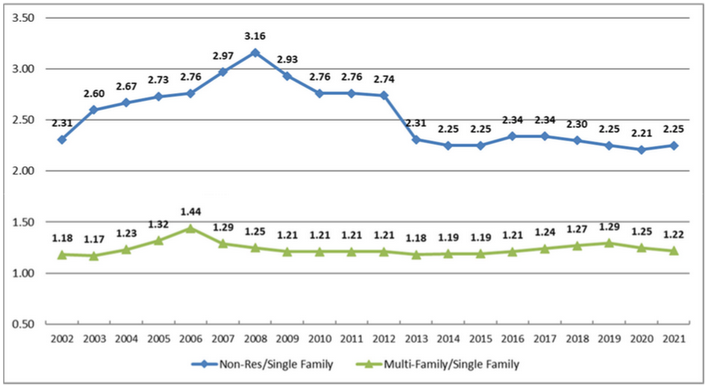

Here are the commercial tax rates relative to single family residential rates over the past twenty years.

Over the past two decades commercial properties have paid between 2.21x and 3.16x the single family residential rate. Currently for every dollar of assessed single family residential development city council collects $2.25 from businesses.

What do other cities do?

In my spare time I look up tax rates for Canadian cities. Every city balances the tax burden differently, but there is one pattern—in every city single-family-detached homes pay the least taxes. What changes is just how much of the burden cities place on commercial properties.

The Municipal Government Act caps the tax burden cities can place on commercial properties at 5x the single family rate. Calgary has one of the highest commercial tax rates in Alberta at 3.5x the single family home tax rate. York, Ontario is on the other end of the spectrum and has the most balanced ratios I’ve seen at roughly 1:1.

If we followed York we would see commercial taxes decrease by -50% and residential taxes increase by roughly +30%. Alternatively, Medicine Hat could potentially put even more of the tax burden on businesses. According to legislation we could more than double our commercial tax rates from current rates. This is what we’ve done in the past. Look at the last graph. Fourteen years ago our commercial tax rate was 3.16x—40% higher than today.

What would happen if we raised the commercial tax rate by 40%? How many small businesses could cope with that increase in overhead costs? Driving around Medicine Hat I see a lot of ‘For Lease’ signs on commercial buildings. Imagine how many more signs we’d see if we increased commercial taxes by another 40%? You don’t have to imagine. Look at Calgary’s vacant downtown. Why do you think that is?

Why would we ever have such high business tax rates? Because when you increase taxes on one property type, taxes go down for other property types. Our commercial tax rates were much higher in the 2000s. Consequently, our single-family rates were low. How low? Just look at 2005.

If a single chart could encapsulate the city’s financial problems it’s this one. The problem is that the public has no idea what the true cost of municipal services is. For the past generation, taxes for 90% of Hatters have been subsidized heavily by our natural gas profits and the over burden on business. We’ve been living a fantasy.

The Medicine Hat Disadvantage

City council proudly trots out this slide every year. A chart created by the City of Calgary, that proves just how low our taxes are. A clear indication of the Medicine Hat Advantage.

This graph is accurate, but also misleading because it only tells half the story. These low residential taxes are not automatically the result of prudent fiscal restraint or efficient delivery of municipal services. You must also consider what your share of the tax burden actually is.

We might have one of the lowest single family residential rates, but Medicine Hat has one of the higher commercial tax rates in the province. If we return to our 2007 tax rates commercial properties would increase, but our residential taxes would decrease. Perhaps lower than Halifax.

One taxpayer’s advantage is another taxpayer's disadvantage.

A principle of fairness

There is no right or wrong balance. Is there any information to help guide this decision? Let’s begin with some baseline information.

What does it cost the city to service different property types?

Do commercial properties cost the city twice as much to service than single-family residential development?

These are hard questions to answer perfectly. I can’t tell you exactly what a neutral tax ratio looks like, but the information we have doesn’t justify current rates.

Infrastructure

Infrastructure is costly. However, water, wastewater, electricity, natural gas, and garbage are rated based. Meaning that you pay for these commodities and the infrastructure to reach your property from your utility bill, not your taxes. Rate-based billing is an accurate way to charge people for the services they use. There’s no discrimination whether it’s a commercial or residential property. It’s pay per use.

Roads and Stormwater

The one infrastructure exemption is roads and stormwater infrastructure, which are covered from our tax supported budget.

Roads: I would argue that roads are neutral connectors that benefit both residential and commercial development equally. Why would we charge businesses twice as much for road use? Afterall, low density development requires more roads. Currently, the city of Medicine Hat covers 112 square kilometers. Most of that area is due to single family detached housing residential development. By the way have you seen the roads in the Light Industrial Area? They are easily the worst roads in the city.

Stormwater: Do businesses use twice as much stormwater infrastructure? Unlikely. One option is to move stormwater infrastructure to a rate based system. This could be tied to density and a way to charge low density residential areas with wide roadways more. It could be charged by lot size, based on the amount of non-permeable surfaces, and also have some multiplier for roadway size. Big box stores with huge non-permeable parking lots would pay more under this change because they create more stormwater discharge.

Emergency Services

Also included in our tax-supported budget are emergency services and recreational amenities. 40% of our municipal budget is emergency services. Do commercial properties use emergency services more than residential properties? Not from what I can tell.

The Medicine Hat Fire Service current strategic plan states on page 26. “Fire statistics indicate residential fires present the greatest risk of injury and death to residents of Medicine Hat. Residential fires are also the most frequent type of fire encountered in the City of Medicine Hat.” Residences use more fire services than commercial properties. Commercial properties also have higher standards of fire safety in building codes. Generally speaking, safety risks are higher where people sleep, i.e. residential areas.

(Note: this conclusion could confuse a base-rate problem. What would the statistics look like if it was # of fires per home or # of fires per $ of assessed value. Those would be more useful metrics when talking about rates. We could better answer this question with more research.)

I don’t have the data for police, but we could analyze where calls of service come from. We can answer this question with research.

We do know that emergency services are primarily judged by response time. The City of Medicine Hat is 112 square kilometers. In an emergency, police and firefighters have to reach every address in that large area quickly. We have three fire stations placed strategically so that firefighters can reach 90% of Medicine Hat within 6 minutes. Each fire station costs $3 million a year. Imagine if we doubled our density and shrunk our city’s footprint by half? Would you need three fire stations? Yet our tax rates are the cheapest for single family residential development—the form of housing that contributes the most to this sprawl.

Emergency services are another service that residences and businesses need equally. I don’t see the justification for charging businesses twice as much for police and fire service.

Recreational services

Businesses benefit from a well-rounded community with good recreational amenities. It helps attract people/labour to the community. But this is an indirect benefit. Residents (people) are the users and the direct beneficiaries. Medicine Hat struggles to maintain our extensive park and trails system. The primary driver of park size and trail system is single-family residential development. Businesses don’t use the Family Leisure Centre or the Esplanade—people do. Again what is the justification to ask commercial development to shoulder double the burden for recreational services?

Municipal Development Plan

My entire argument is confirmed by the City of Medicine Hat’s internal documents. A growth management study undertaken in preparation for the Municipal Development Plan found that city council makes money on certain types of property—meaning we charge more in taxes than they cost to service. It also found that we lose money on other types of property—meaning we don’t charge enough in taxes to cover their costs. We make money on commercial properties and lose money on every residential neighbourhood.

The central feature of the Municipal Development Plan argues for aligning servicing and costs. The Transect Model aims to reduce service levels in lower density outlying areas, while increasing them in higher density areas. The MDP aims to adjust the current disconnect between services and costs on the service side. I’m suggesting we also approach this imbalance from the taxation side as well. This plan not only aligns with the MDP—it is complimentary.

In summary, the information we have does not support our current tax distribution. And just because our current commercial rates are lower than the crazy 2000s should not give us any comfort. We still have work to do.

The Canadian dream

Politically, the status quo is understandable. Most of us live in a single family detached house. It is the Canadian dream. It’s natural that politicians want to make this lifestyle as cheap as possible. But trying to create affordable housing by hiding servicing costs is ultimately a self-defeating strategy.

Our community encourages a resource intensive lifestyle and asks others to pay for it. This will bankrupt the city. The city is already straining financially.

There are other ways to create affordable housing that doesn’t play favourites between low density and high density housing. There are other ways to create affordable single family detached housing, which I’ll discuss in an upcoming column.

Renewing our bonds with business

The constant stream of stories about corporate greed have polluted our relationship with business. Business is an integral, organic part of our lives. We think of business people as rich instead of business and entrepreneurship as a way for people to improve their lives.

Economic freedom is an essential partner to political freedom. The freedom to create your own job is a critical part of our society. If you’re discriminated against by other companies or employers or the government—you can strike out on your own. And given the age of disruption we live in it’s imperative that entrepreneurship succeeds. A good life doesn’t depend only on the size of your house. It also depends on whether you have a job.

It’s getting harder to start your own business. Utilities and property taxes are unavoidable and thus the primary driver of overhead costs. With our high commercial tax rate city council sets an artificially high floor for entry into business. (City Hall has seen a recent spike in the number of home occupancy business applications due to these businesses looking to save overhead costs. Another indication our commercial tax rate is too high.)

Internal city documents acknowledge that the status quo favours big business over small business. That’s an incredible admission. We’re literally favouring big over small with our current tax policy.

The University of Calgary’s School of Public Policy released a research paper in March 2021 on the impact of property taxation on business investment. Among their findings was that for every 10% increase in commercial property taxes there was a corresponding 7% decrease in investment. No wonder we’ve had such difficulty sustaining economic growth in Medicine Hat.

Next steps

There’s nothing sexy about this idea. Indeed it’s politically difficult. But it sets the foundation for a variable, diverse, dynamic local economy. It’s also a lot less risky than continuing to give tax breaks to companies and developers to spur economic development.

This tax reform cannot be done overnight. It will take successive city councils more than a decade to rebalance. This idea needs widespread acceptance in our community before it can be implemented.

Extra credit reading